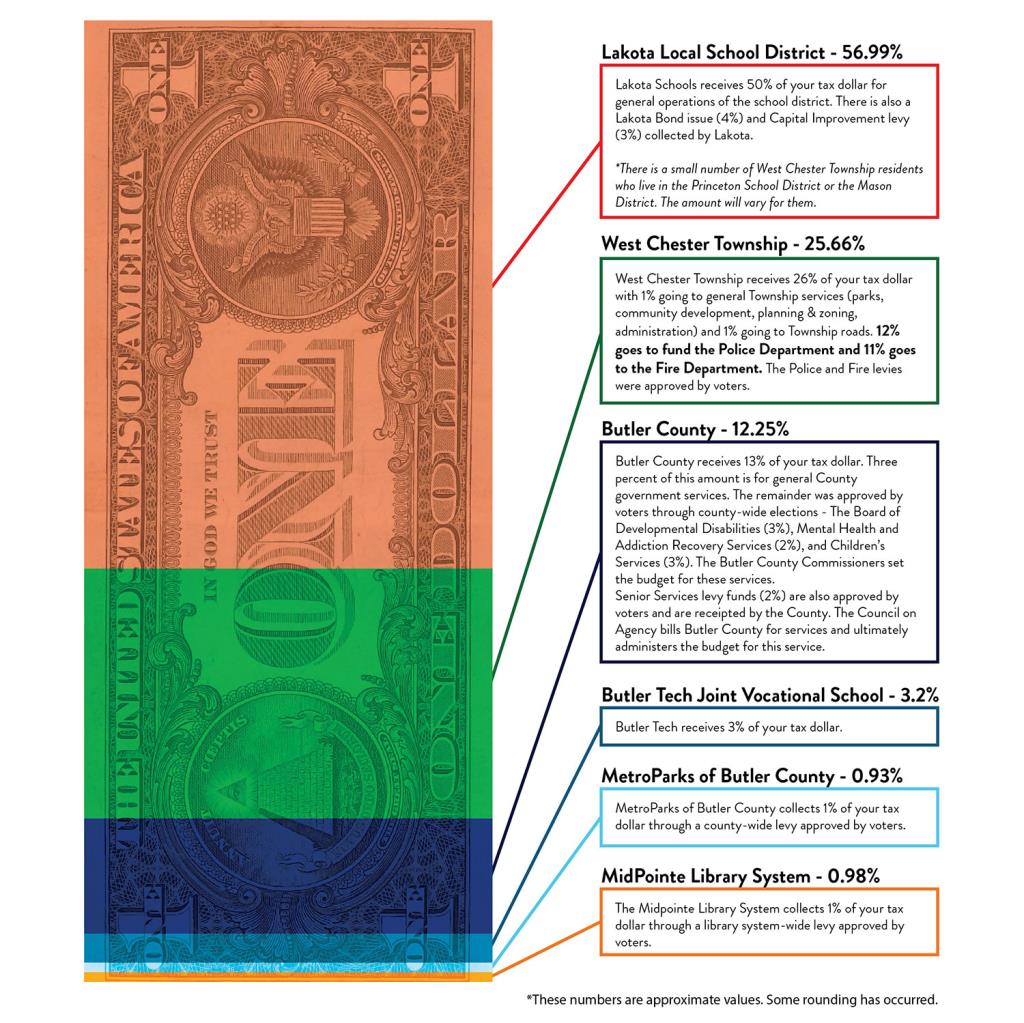

A percentage breakdown of one West Chester tax dollar illustrates where taxpayer money goes.

Lakota Local School District - 56.99%

Lakota Schools receives about 50% of your tax dollar for general operations of the school district. There is also a Lakota Bond issue (4%) and Capital Improvement levy (3%) collected by Lakota.

*There is a small number of West Chester Township residents who live in the Princeton City School District or the Mason City School District. The amount will vary for them.

West Chester Township - 25.66%

West Chester Township receives about 26% of your tax dollar with 1% going to general Township services (parks, community development, planning & zoning, administration) and 1% going to Township roads. Twelve percent goes to fund the Police Department and 11% goes to the Fire Department. The Police and Fire levies were approved by voters.

Butler County - 12.25%

Butler County receives about 13% of your tax dollar. Three percent of this amount is for general County government services. The remainder was approved by voters through county-wide elections – The Board of Developmental Disabilities (3%), Mental Health and Addiction Recovery Services (2%), and Children's Services (3%). The Butler County Commissioners set the budget for these services.

Senior Services levy funds (2%) are also approved by voters and are receipted by the County. The Council on Aging bills Butler County for services and ultimately administers the budget for this service.

Butler Tech Joint Vocational School - 3.2%

Butler Tech receives about 3% of your tax dollar.

MetroParks of Butler County - 0.93%

MetroParks of Butler County collects about 1% of your tax dollar through a county-wide levy approved by voters.

MidPointe Library System - 0.98%

The MidPointe Library System collects about 1% of your tax dollar through a library system-wide levy approved by voters.